schedule c tax form llc

Within the parameters set out by the form small business owners can. Edit Sign and Print IRS Schedule C Form 1040 Tax Form on Any Device with pdfFiller.

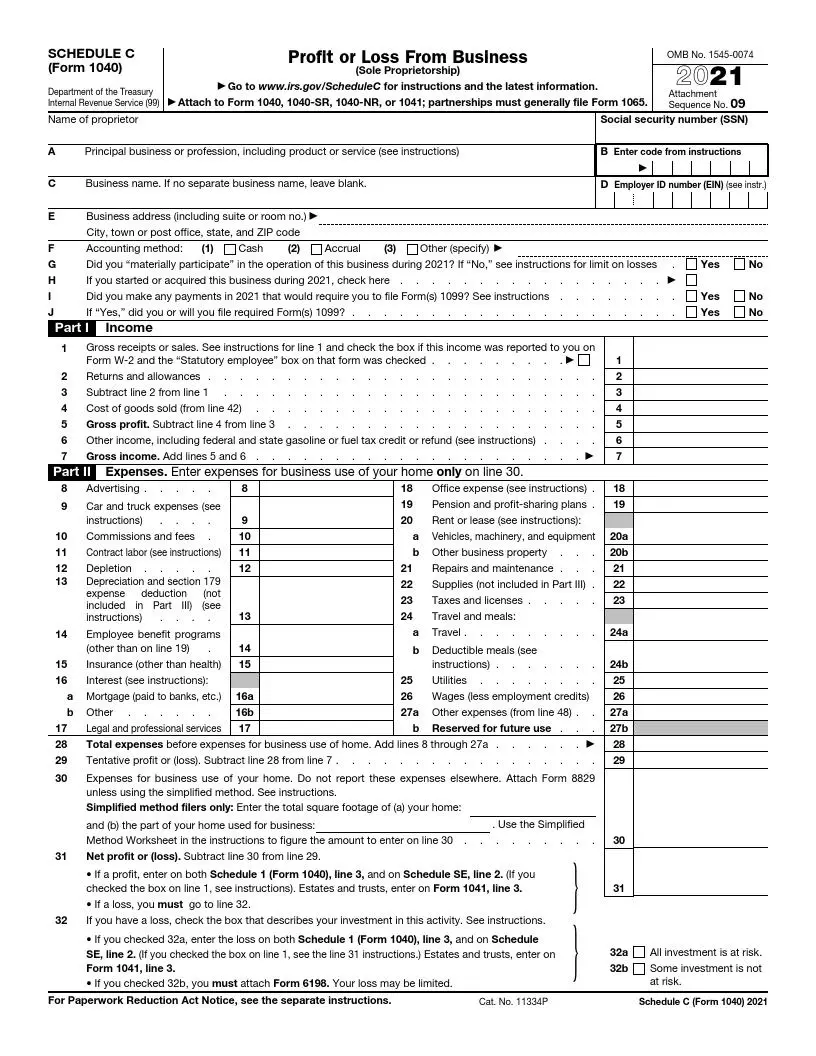

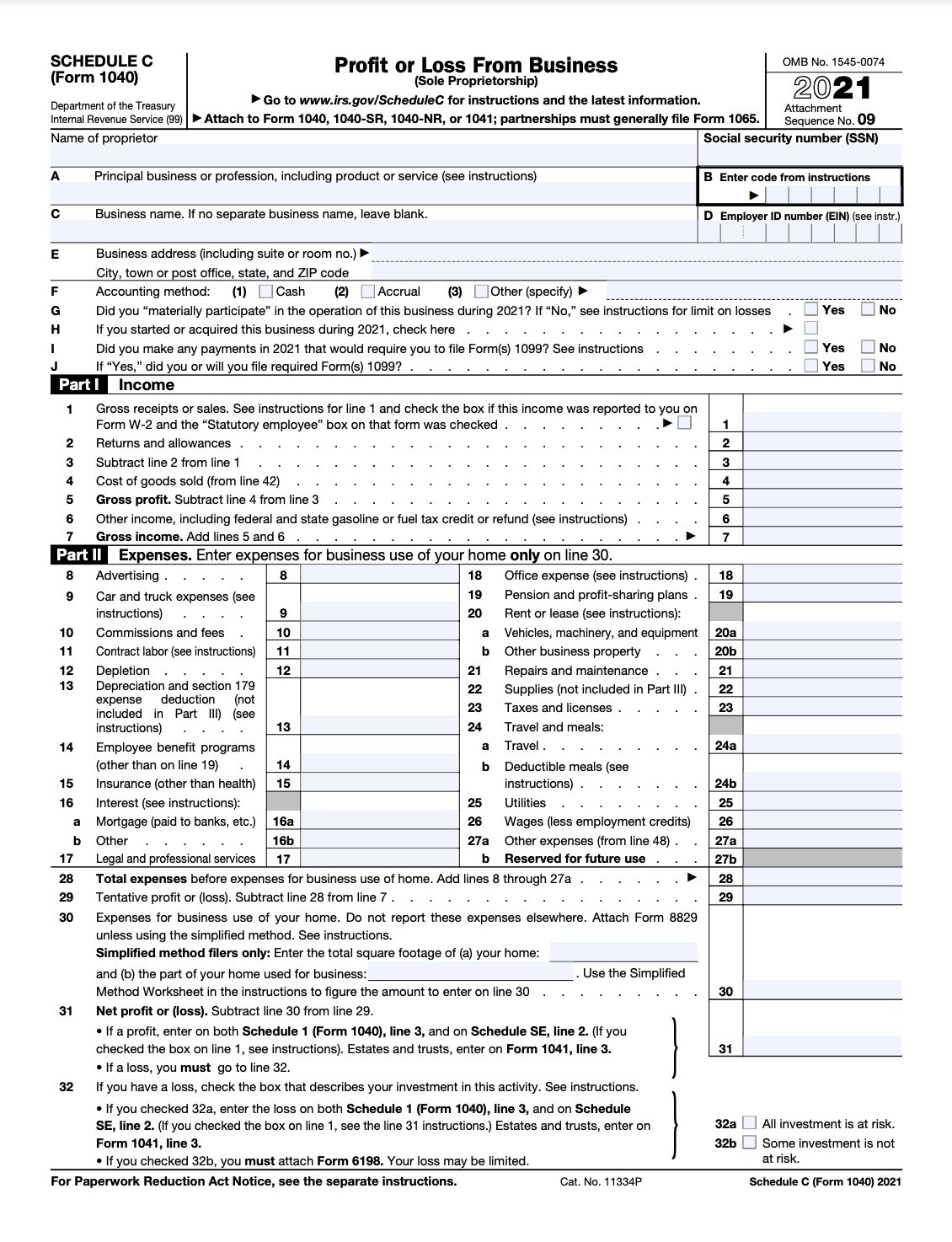

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

Youll report all business income and.

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

. Schedule C is used to report self-employment income on a personal return. Get Trusted Legal Forms. The form is titled Profit or Loss from Business Sole.

The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. Self-employment income is how we describe all earned income derived from non-W-2 sources. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

In the second part of the form deduct your business. Legal Forms with e-Signature solution. For simplicity self-employment taxes are 153 of net income.

At any time during the last 12 of the tax year more than 50 of the value of the LLCC-Corp outstanding stock is owned directly or indirectly by or for 1 2 3 4 or 5 people. The profit is the amount of money you. What Is Schedule C.

Level 15 June 6 2019 258 AM Your single member LLC is considered a disregarded entity as far as the IRS is concerned. If you are self-employed or. As a single member LLC you are considered a disregarded entity for federal and most state tax purposes.

Share E-Sign Instantly. If the LLC chose partnership status file IRS Form 1065. If you received any 1099-NEC 1099-MISC or 1099-K tax forms reporting money you earned working as a contractor or selling stuff youll have to report that as income on Line 1 of.

The Tax Organizer is a simple form that is easy to fill out and will provide all of the necessary information to prepare your taxes. Schedule C is a tax form for small business owners who are either a sole proprietor or have a single-member LLC. Schedule C is the business tax return used by sole proprietors and single-member LLCs.

What Is Schedule C. Even though you dont have income from your business you would still file a Schedule C with your expenses. There are five sections in a Schedule C form.

This would all be filed on your personal Form 1040. Complete IRS Form 1120 if you elected corporate taxation. The Schedule C form benefits both small business owners and the US Internal Revenue Service IRS.

Its used to report net income for a small business. Create Legally Binding e-Signatures on Any Device. As such you report all your net income or loss on a Schedule C of.

Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes. Ad Download or Email Business Income Form More Fillable Forms Register and Subscribe Now. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month Your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of.

The owner of an LLC taxed as a Sole Proprietorship will pay self-employment taxes on all profits in the company. File your 1040 Schedule C if filing as a sole proprietorship. Schedule C is used to report income and expenses from a business you own as a sole proprietor or single-member LLC.

As a single-member LLC you will be considered a sole proprietorship and your income and expenses will be recorded on Schedule C of your personal tax return. In the first part you must detail all of your business revenue and work out your gross profit. Download the Tax Organizer Form pdf.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

What Is An Irs Schedule C Form

What Is An Irs Schedule C Form

How To Fill Out Your Schedule C Perfectly With Examples

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Filing A Schedule C For An Llc H R Block

2021 Schedule C Form And Instructions Form 1040

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Schedule C For Business Taxes Youtube

What Is A Schedule C Tax Form H R Block

How To Fill Out Schedule C For Business Taxes Youtube

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Business Activity Code For Taxes Fundsnet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)